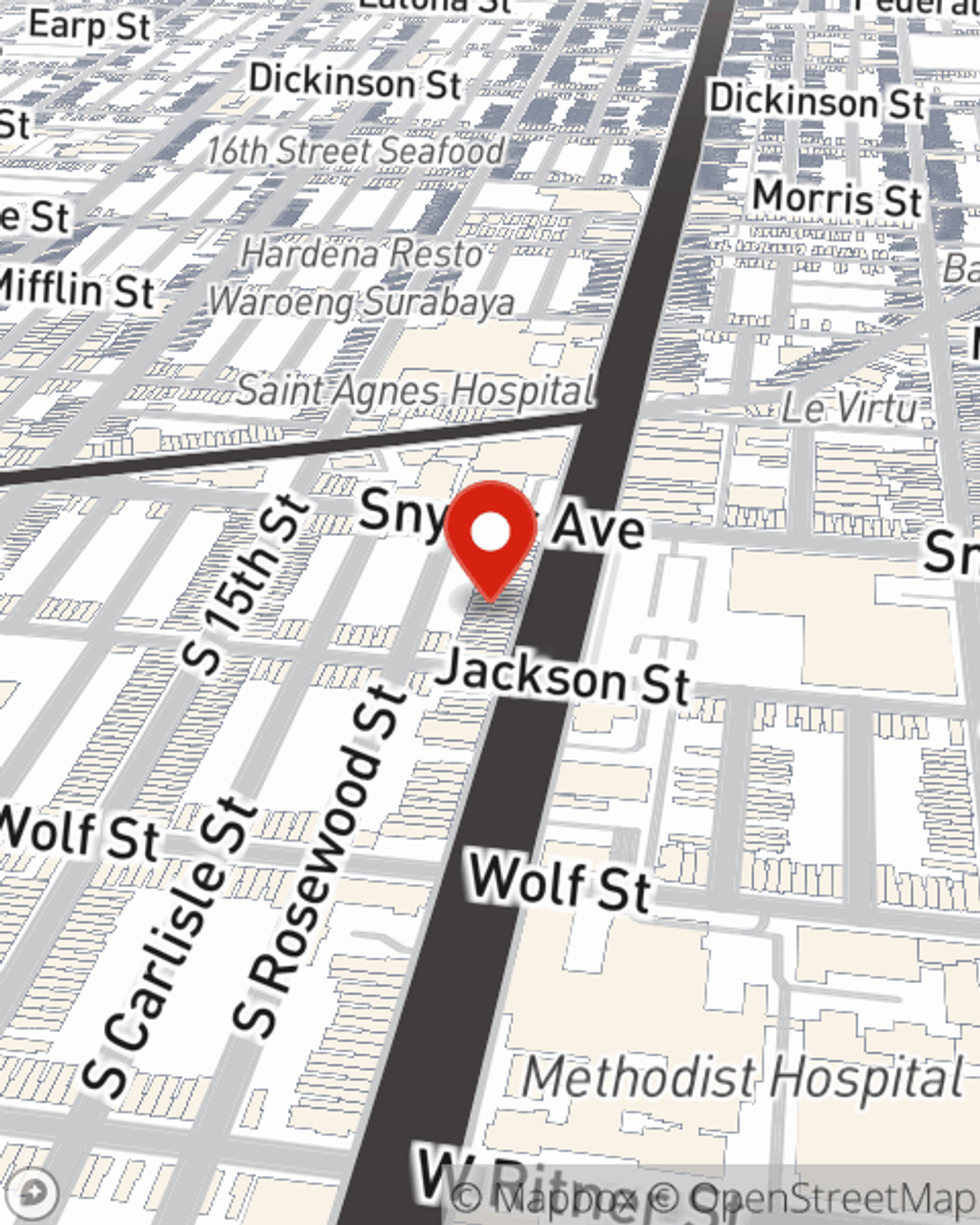

Business Insurance in and around Philadelphia

One of the top small business insurance companies in Philadelphia, and beyond.

No funny business here

Cost Effective Insurance For Your Business.

Preparation is key for when the unexpected happens on your business's property like a customer slipping and falling.

One of the top small business insurance companies in Philadelphia, and beyond.

No funny business here

Keep Your Business Secure

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or errors and omissions liability, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Vicki Neill can also help you file your claim.

So, take the responsible next step for your business and call or email State Farm agent Vicki Neill to explore your small business insurance options!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Vicki Neill

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.